Need payment processing?

Let your Agent/ISO business take flight with CoPilot.

Our merchant management portal, made just for you. You’re busy running a business - make it easier with faster onboarding, merchant data reporting, simple device ordering and management, and more!

Track Merchant Onboarding Statuses

Track activity from application to approval, and quickly onboard new accounts with an easy-to-use digital application.

Manage Your Portfolio

Get line-item detail residual reporting and calculations, plus insights to sub-partner performance.

Get Human Support

Manage account reconciliation, submit requests via tickets and view merchants' deposits, batch reports, transactions, and more.

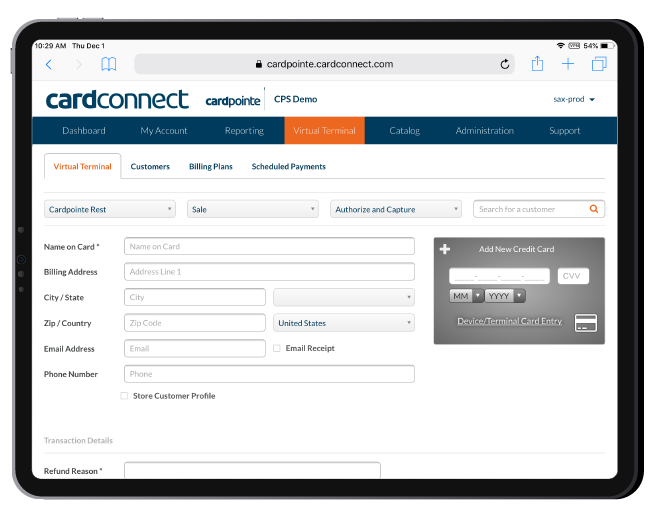

Connect your merchants to better technology and solutions.

Access an unparalleled product suite that puts you in the game to sell to almost any merchant, including: small shops, online retailers, restaurants, and more.

The CardConnect Difference

Don't just take it from us - find out what our partners are saying.

Contact Us

Your success in payments starts here! Please select your partnership type below so we can connect.