More ways to pay.

More features to love.

Patented Tokenization: Replaces customer data with irreversible tokens that are useless to hackers

Point-to-Point Encryption (P2PE): Can be paired with our PCI-validated, P2PE enabled devices to protect cardholder data throughout its full lifecycle

Simple Device Integration: Integrate with a suite of secure EMV-capable physical devices

How It Works:

1

A customer calls to place an order and provides their payment details over the phone.

2

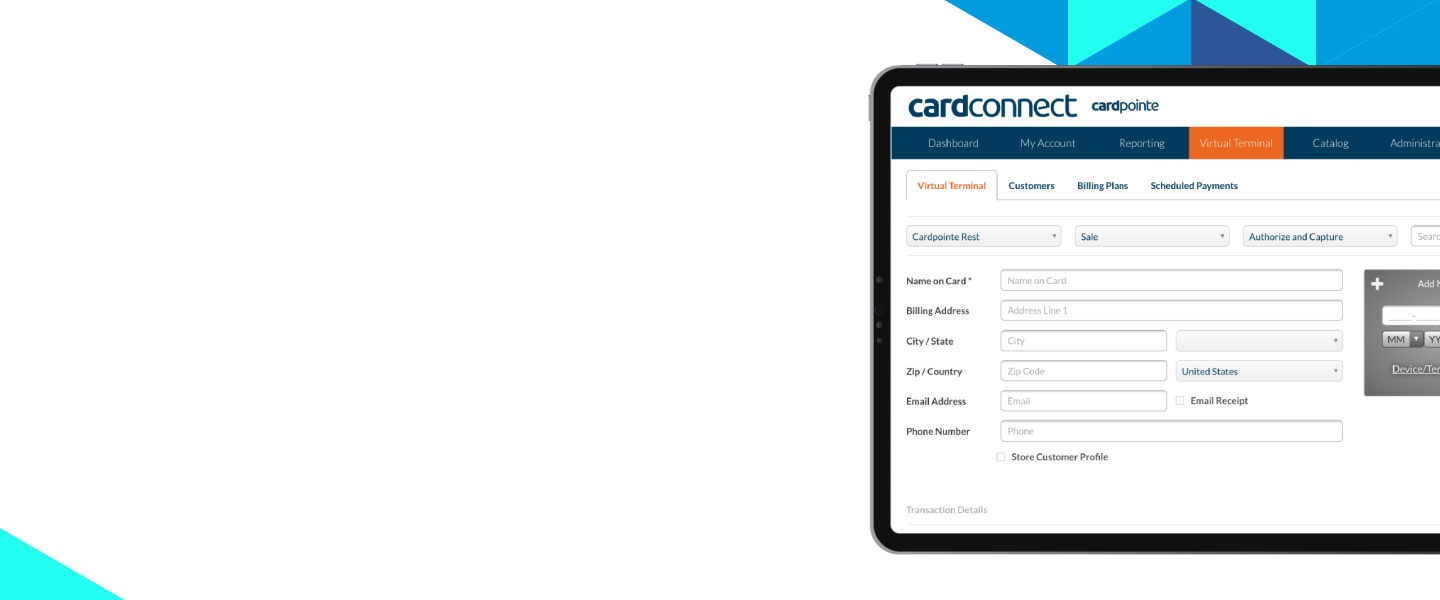

The customer’s payment details are manually entered into the secure Virtual Terminal.

3

Users can instantly view successful transaction details and email customer receipts.

Contact Us

Your success in payments starts here! Please select your partnership type below so we can connect.