CardPointe payment management software.

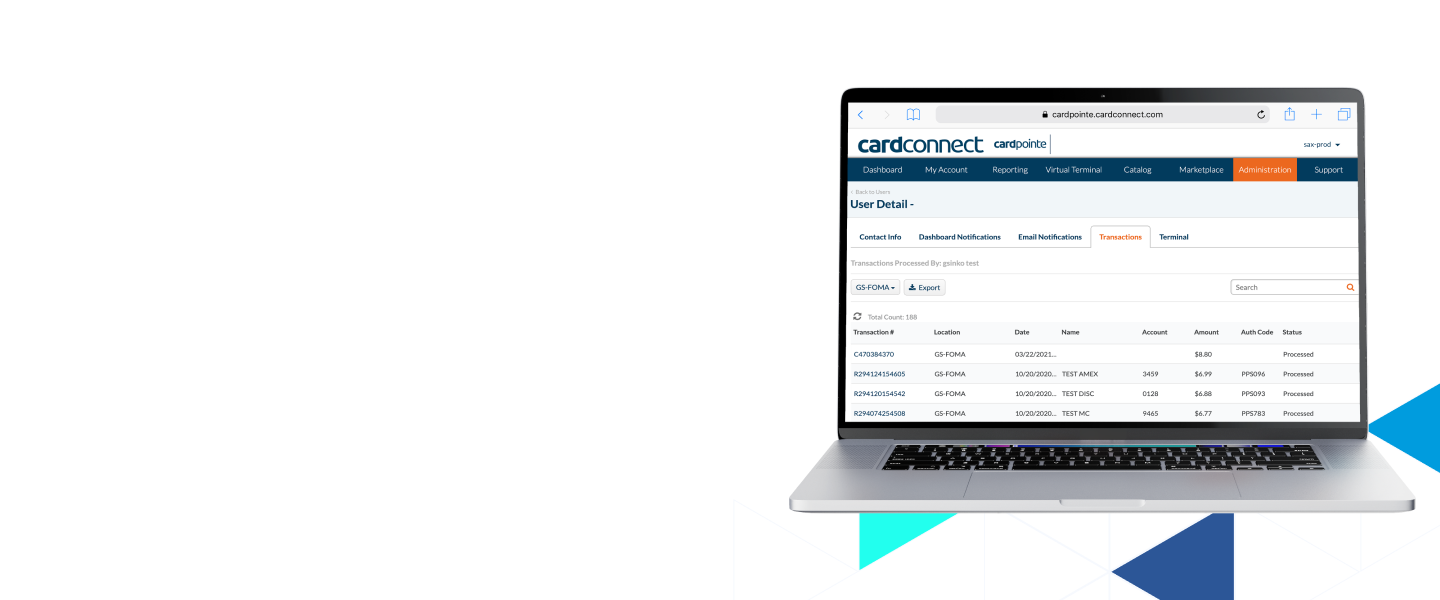

The CardPointe platform enables businesses to easily review their credit card transactions in real-time, all from one location.

Plus, bring these features right to your fingertips with the mobile credit card processing application for Apple and Android devices.

Transaction management made simple.

Easily identify best-selling products, most loyal customers, top-performing employees, and more.

Monthly volume reports allow

users to closely monitor business performance and progress.

Powerful filters allow users to refine transactions using a number of parameters including date, credit card number, status, and more.

Easily access and download

reports to compare sales figures

for different locations.

Contact Us

Your success in payments starts here! Please select your partnership type below so we can connect.